The National Football League (NFL) season begins Thursday night and bettors are rushing to crypto-based prediction market Polymarket to place their early-season slips.

Already, more than $600,000 has been wagered on the opener between the Philadelphia Eagles and Dallas Cowboys, a sum that eclipses the roughly £150,000 ($201,000) taken in by Europe’s largest betting exchange, Betfair. It’s still little more than a rounding error on the $100 million or more in wagering generally seen on individual football games via traditional channels.

From Politics to Pigskin

Polymarket founder Shayne Coplan said Wednesday that the company had received the all-clear from the U.S. Commodity Futures Trading Commission (CFTC), granting it the ability to operate across all 50 states, including those like Texas where traditional sports betting is prohibited.

The regulatory breakthrough followed a widely seen social media marketing campaign that teased, “Legal football trading is coming to ALL 50 states this fall.”

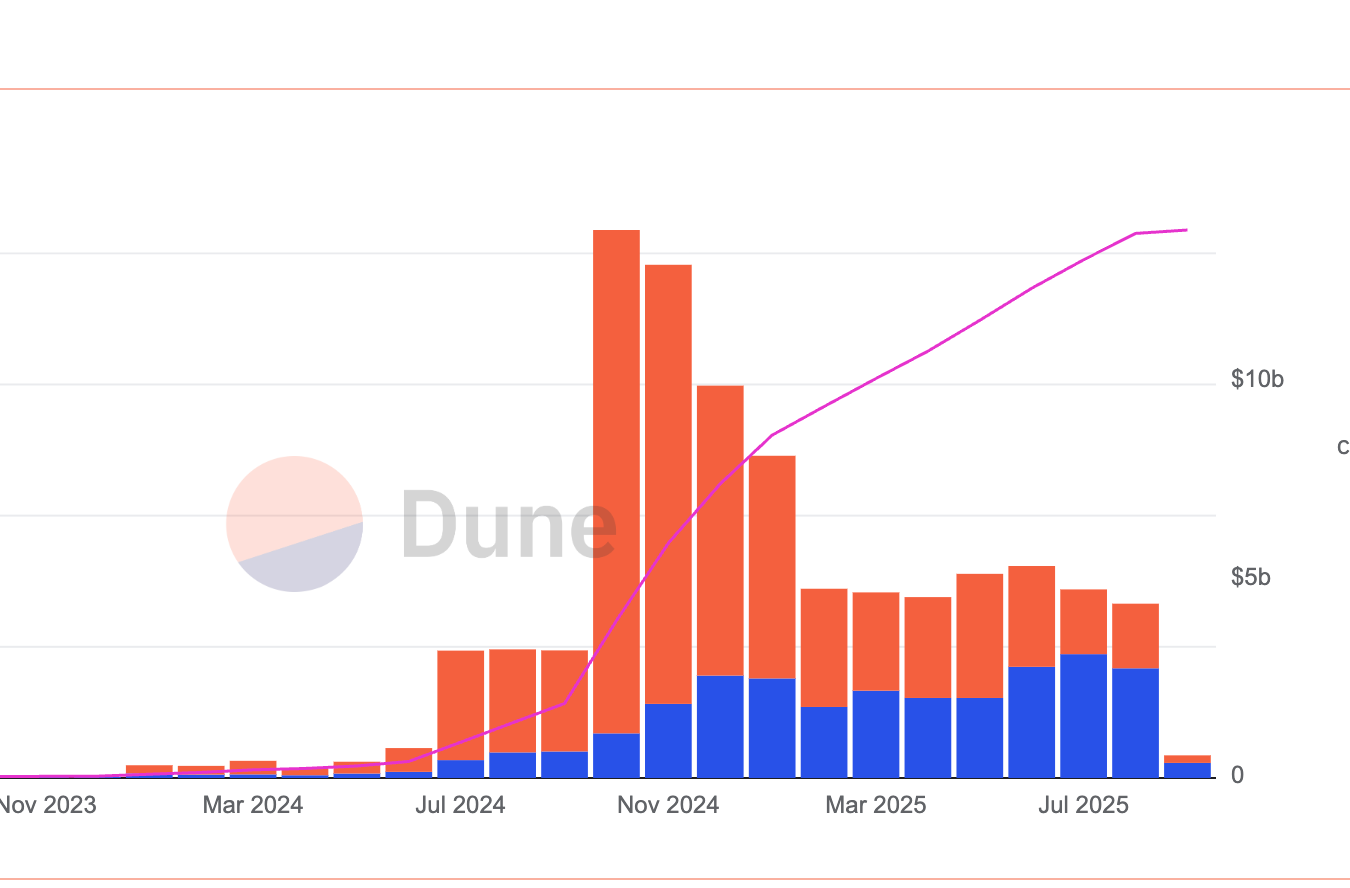

The timing couldn’t be more critical. According to Dune Analytics, Polymarket’s volumes have slumped in 2025, falling from a $2 billion record high in November during the U.S. election frenzy to just $664 million in August.

While expected, the drop illustrates Polymarket’s dependence on political cycles. During the election, the platform became a media barometer, with markets often cited alongside traditional polls to track candidate performance.

After the votes were counted, volumes cooled and attention shifted to novelty markets, sometimes controversially, such as wagers on whether Ukrainian President Volodymyr Zelenskyy would don a suit before July.

A $107 Billion Market Beckons

The pivot toward sports comes as sports betting remains a juggernaut industry, worth an estimated $107 billion in 2024.

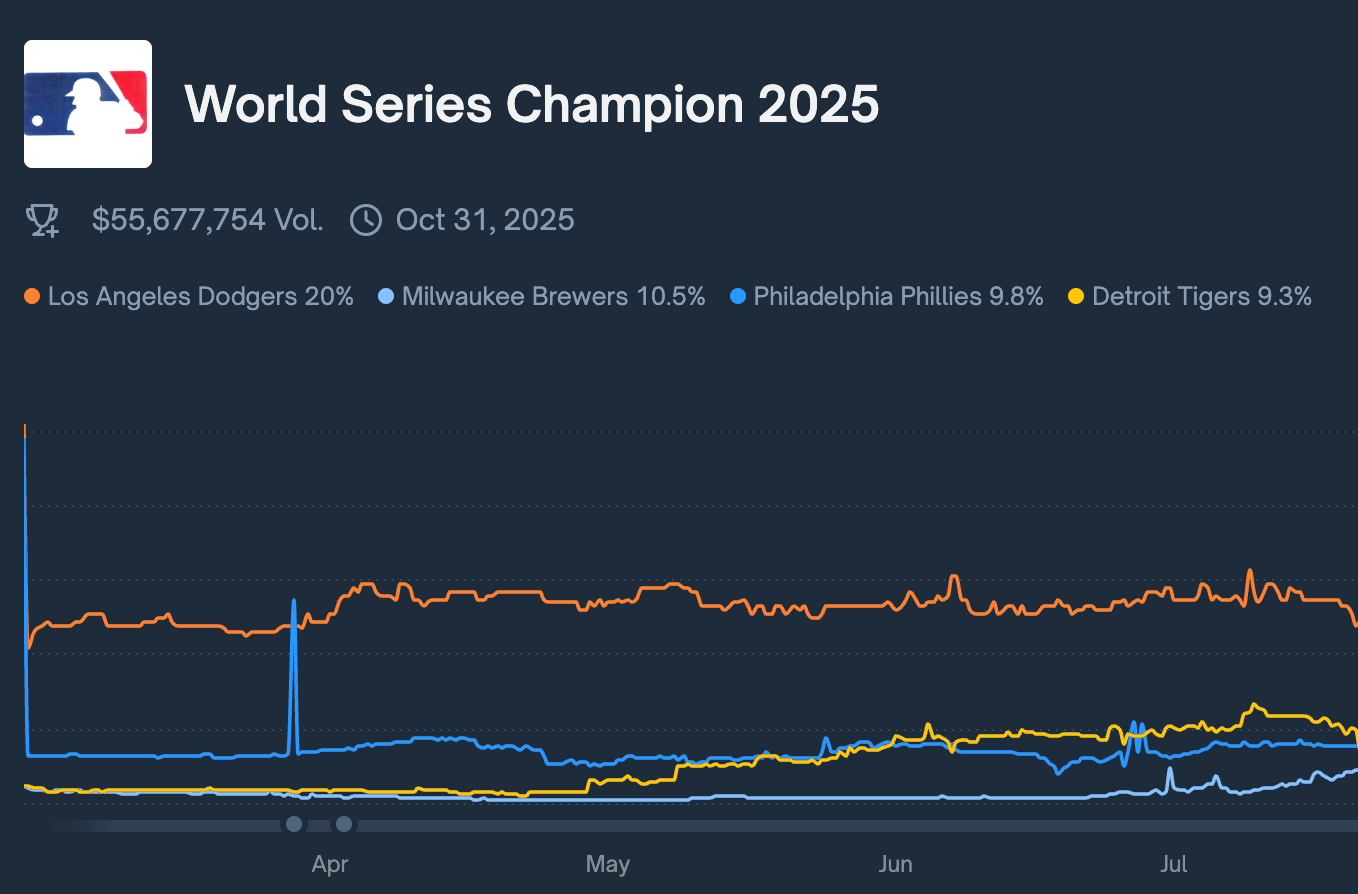

Early indicators suggest Polymarket could capture meaningful share: this year alone, users have wagered over $55 million on MLB World Series markets, hinting that NFL betting volumes could accelerate as the season matures.

The NFL is particularly prized. Not only does it draw America’s largest fan base, but it also fuels betting spikes week after week through fantasy leagues, sportsbooks, and now, prediction markets.

Ready to Take on the Industry

With the CFTC’s green light and an NFL launch generating volumes that rival traditional bookmakers, Polymarket is positioning itself to take on the broader sports betting industry.

Its model remains distinct: instead of wagering against a house, users trade contracts with each other, with prices moving like markets in real time. This structure makes Polymarket function less like a sportsbook and more like an exchange, where odds are set by the collective actions of traders rather than by oddsmakers.

That difference could prove disruptive. By blending prediction markets with mainstream sports, Polymarket isn’t just entering a $100 billion-plus industry, it’s changing how sports fans can speculate on the outcomes.