By Francisco Rodrigues (All times ET unless indicated otherwise)

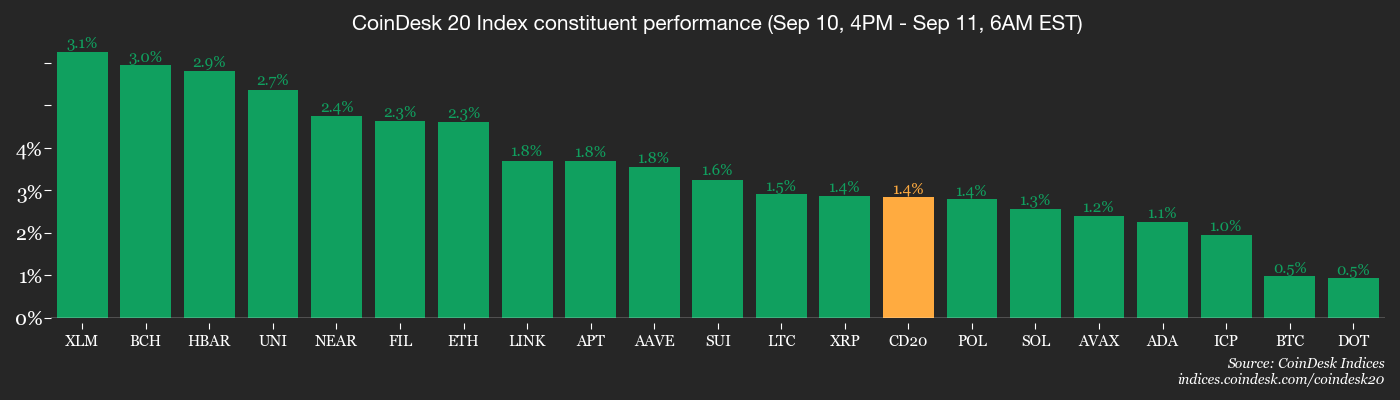

Bitcoin (BTC) is up around 1.4% in the past 24 hours as investors await key inflation data in the U.S., which could shape expectations for a much-discussed interest-rate cut by the Federal Reserve.

Before that hits though, the European Central Bank announces its own interest-rate decision. It’s expected to keep rates steady, a surprise move may ruffle a few feathers.

Economists are forecasting a modest rise in the U.S. Consumer Price Index (CPI) due at 8:30 a.m. That, coupled with the near 1 million jobs revision from the Bureau of Labor Statistics earlier this week, points to growing chances of rate cuts.

On Polymarket, bettors now see a 79% chance of a 25 basis-point rate cut this month, while perceived odds of a 50 bps drop have surged to 18% from 5.4% in a week. The CME’s FedWatch tool shows traders positioned for a 92% chance of a 25 bps cut, and an 8% chance of an even deeper one.

A rate cut would benefit risk assets, and the growing odds of such an event are being felt on the market. Spot bitcoin and ether ETFs attracted a combined $928 million in net inflows yesterday and bitcoin hit $114,000 for the first time since early August.

Still, some analysts are flashing caution. Jake Ostrovskis, the head of OTC Trading at Wintermute, pointed out that persistent inflation and slowing growth are raising stagflation concerns.

Since late August, Ostrovskis said, investors have been moving away from ether after its outperformance and back into bitcoin. Options activity reflects that shift, with traders protectively buying puts on ETH and risk reversals for March and June 2026 dipping into negative territory.

This “creates a setup where the market feels well hedged” should pressures ease, Ostrovskis noted. “At the end of the day, we’re close to the beginning of a rate-cutting cycle.”

Meanwhile, gold remains near record highs, with the bitcoin-to-gold ratio approaching resistance levels that previously signaled crypto bottoms, analysts at QCP Capital said.

“If history rhymes, bitcoin could be in the process of establishing another bottom, setting the stage for the next major leg higher,“ they wrote.

Still, geopolitical turmoil shouldn’t be ignored. Russia violated Poland’s airspace this week, forcing NATO to scramble its jets and prompting Polish Prime Minister Donald Tusk to say this was “the closest we have been to open conflict since World War II.”

Tusk underlined there’s “no reason to believe we’re on the brink of war,” and Moscow denied responsibility for the attack. Stay alert!

What to Watch

- Crypto

- Sept. 11, 9 a.m.: Swissblock webinar on “The Final Innings of This Bull Cycle.”

- Sept. 11: Figure Technology Solutions, a blockchain-powered lender, begins trading on Nasdaq Global Select Market under ticker FIGR following an IPO priced at $25 per share.

- Sept. 12: Gemini Space Station, the Winklevoss twins’ crypto exchange, begins trading on Nasdaq Global Select Market under ticker GEMI; IPO price range $24-$26.

- Macro

- Sept. 11, 8:30 a.m.: August U.S. Core CPI YoY Est. 3.1%, MoM Est. 0.3%; CPI YoY Est. 2.9%, MoM Est. 0.3%.

- Earnings (Estimates based on FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Compound DAO is voting on extending its COMP yield strategy with MYSO’s decentralized protocol and scaling it up to $9 million worth of tokens, targeting a 15% annual yield for the DAO. Voting ends Sept. 11.

- Hyperliquid to vote on who issues its USDH stablecoin. Voting takes place Sept. 14.

- Unlocks

- Sept. 11: Aptos (APT) to unlock 2.2% of its circulating supply worth $50.89 million.

- Token Launches

- Sept. 11: Sky (SKY) to be listed on OKX.

- Sept. 12: Unibase (UB) to be listed on Binance Alpha, MEXC, and others.

Conferences

- Day 3 of 5: Boston Blockchain Week (Quincy, Massachusetts)

Token Talk

By Oliver Knight

- Mantle (MNT) led a wider altcoin jump on Thursday, rising to a record high of $1.62 on the back of significant volume on derivatives exchange Bybit.

- The native token of its namesake’s layer-2 network is primarily a governance token, but is also widely staked as investors look to secure a yield on their holdings.

- The annualized return of staking MNT on Coinbase stands at 71%, far more than the 1.86% return holders get for staking ether (ETH) on the same platform.

- This has led to more than two thirds of MNT’s total supply being staked, resulting in a lack of supply on exchanges amid a wave of demand.

- Trading volume on Bybit hit $195 million over the past 24 hours, an 83% rise on the previous 24 hours.

- Open interest is also up 20%, outpacing the 15% gain in price, which can be attributed to traders opening new leveraged positions to bet on further upside.

- The new record high price could pave the way for other altcoins to rally too.

- The “altcoin season” index rose to 67/100 on Thursday, demonstrating trader preference to trade more speculative and lower liquidity assets like MNT as opposed to crypto majors BTC and ETH.

Derivatives Positioning

By Omkar Godbole

- Open interest (OI) in BTC futures and perpetual futures listed worldwide remains elevated at 736K BTC, just short of last month’s record high 748K BTC.

- In the past 24 hours the tally has remained relatively unchanged, alongside tentative trading in futures tied to altcoins, as traders adopted a cautious stance before today’s critical U.S. CPI report.

- Volmex’s one-day BTC implied volatility index continues to fluctuate within a months long range of 25% to 50%, indicating that the market is not anticipating significant volatility from the CPI announcement. The index recently stood at 35.50%, suggesting an expected one-day price movement of about 1.85%.

- Volatility indices linked to ETH, SOL and XRP also remain locked in recent ranges.

- On the CME, OI in bitcoin futures remains depressed at multimonth lows, while OI in ether continues to recede from recent record highs.

- Options, however, show the opposite trend. BTC options OI has increased to over 50,000 BTC, the most since April. And ether options OI has jumped to 260K ETH, the highest since August 2024.

- On Deribit, 25-delta risk reversals continue to exhibit a bias toward put options in bitcoin and ether. Flows on OTC desk Paradigm continued to lean bearish, with some traders picking up the September expiry $4,000 ETH put.

Market Movements

- BTC is up 0.26% from 4 p.m. ET Wednesday at $113,916.87 (24hrs: +1.5%)

- ETH is up 1.93% at $4,414.68 (24hrs: +2.32%)

- CoinDesk 20 is up 1.24% at 4,209.95 (24hrs: +2.13%)

- Ether CESR Composite Staking Rate is down 7 bps at 2.8%

- BTC funding rate is at 0.0072% (7.9245% annualized) on Binance

- DXY is up 0.2% at 97.98

- Gold futures are down 0.62% at $3,659.30

- Silver futures are down 0.34% at $41.46

- Nikkei 225 closed up 1.22% at 44,372.50

- Hang Seng closed down 0.43% at 26,086.32

- FTSE is up 0.38% at 9,260.84

- Euro Stoxx 50 is up 0.18% at 5,371.28

- DJIA closed on Wednesday down 0.48% at 45,490.92

- S&P 500 closed up 0.3% at 6,532.04

- Nasdaq Composite closed unchanged at 21,886.06

- S&P/TSX Composite closed up 0.40% at 29,179.39

- S&P 40 Latin America closed up 0.81% at 2,822.97

- U.S. 10-Year Treasury rate is up 1.3 bps at 4.045%

- E-mini S&P 500 futures are up 0.12% at 6,547.50

- E-mini Nasdaq-100 futures are up 0.17% at 23,917.75

- E-mini Dow Jones Industrial Average Index are up 0.11% at 45,592.00

Bitcoin Stats

- BTC Dominance: 58.14% (-0.37%)

- Ether-bitcoin ratio: 0.03872 (1.45%)

- Hashrate (seven-day moving average): 1030 EH/s

- Hashprice (spot): $53.17

- Total fees: 4.04 BTC / $456,196

- CME Futures Open Interest: 137,110 BTC

- BTC priced in gold: 31.5 oz.

- BTC vs gold market cap: 8.86%

Technical Analysis

- S&P 500 e-mini futures have carved out a rising wedge pattern in a move to record highs.

- When a rising wedge, which is a bearish reversal pattern, appears after an extended rally to record highs, it significantly increases the probability of a sharp downside move. It suggests that buyers are exhausted and the rally is running on fumes.

- A potential sell-off in futures could weigh over bitcoin and wider crypto market.

Crypto Equities

- Coinbase Global (COIN): closed on Wednesday at $315.34 (-1.08%), +0.7% at $317.55 in pre-market

- Circle (CRCL): closed at $113.69 (-3.64%), +1.46% at $115.35

- Galaxy Digital (GLXY): closed at $26.08 (-1.88%), +0.73% at $26.27

- Bullish (BLSH): closed at $52.62 (-2.21%), +0.72% at $53

- MARA Holdings (MARA): closed at $15.86 (-0.44%), +0.82% at $15.99

- Riot Platforms (RIOT): closed at $16.4 (+7.82%), +0.24% at $16.44

- Core Scientific (CORZ): closed at $15.99 (+10.05%), +0.81% at $16.12

- CleanSpark (CLSK): closed at $10.03 (+3.72%), +0.5% at $10.08

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $35.49 (+7.12%)

- Exodus Movement (EXOD): closed at $27.49 (+2.77%), unchanged in pre-market

Crypto Treasury Companies

- Strategy (MSTR): closed at $326.45 (-0.63%), +0.57% at $328.30

- Semler Scientific (SMLR): closed at $28.02 (-0.18%)

- SharpLink Gaming (SBET): closed at $16.09 (-3.6%), +2.05% at $16.42

- Upexi (UPXI): closed at $5.46 (-0.73%), +2.75% at $5.61

- Mei Pharma (MEIP): closed at $3.07 (+10.43%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $741.5 million

- Cumulative net flows: $55.6 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily net flows: $171.5 million

- Cumulative net flows: $12.86 billion

- Total ETH holdings ~6.38 million

Source: Farside Investors

Chart of the Day

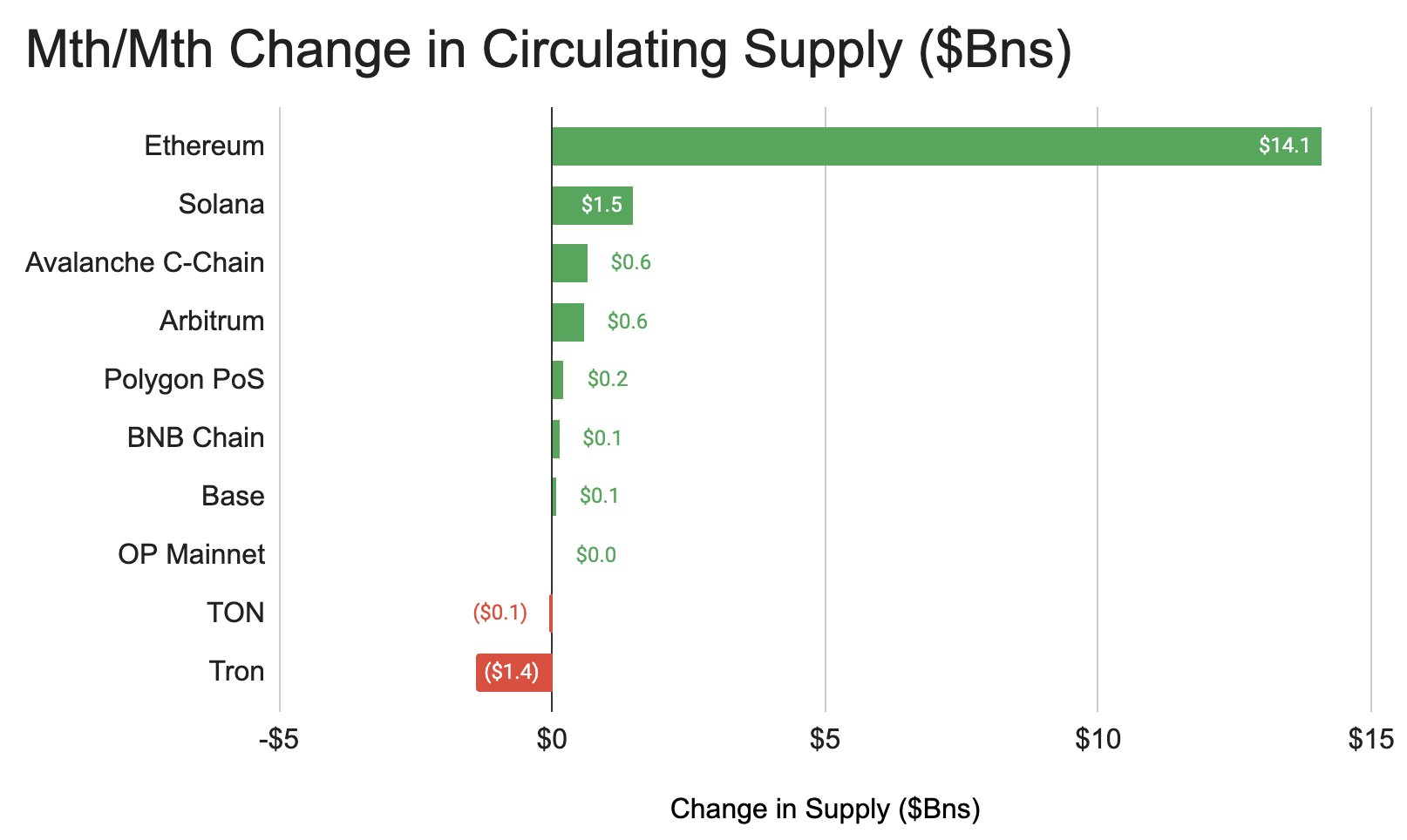

- The total circulating supply of stablecoins on Ethereum rose more than $14 billion in August, the biggest gain among top blockchains.

- The growth was led by USDC, UDST, USDe.

- The data highlights Ethereum’s dominance in stablecoins, which stands out as one of the few crypto sectors with strong real-world applications.

While You Were Sleeping

- Blockchain-Based Lender Figure Prices IPO at $25 Per Share, Raising Nearly $788M (CoinDesk): Figure priced 31.5M shares at $25 each for its Sept. 11 Nasdaq debut under ticker FIGR, with about three-quarters newly issued and the rest sold by current investors.

- Broad U.S. Price Increases Expected in August Amid Tariff Pass-Through (Reuters): U.S. CPI likely rose 0.3% in August as higher gasoline, coffee and beef costs kicked in, with depleted pre-tariff inventories now forcing businesses to pass on import duties.

- Avalanche Blockchain Aims to Raise $1Bn for Crypto-Hoarding Companies (Financial Times): The Avalanche Foundation is in talks with investors to create two crypto treasury vehicles, one new and one converted, that would buy discounted AVAX tokens.